This Chart Pattern Last Appeared at the End of the Dot-Com Crash

Microsoft is 20% below its 200-day moving average. The rotation graphs are curling Northeast. History doesn't repeat — but it rhymes loudly.

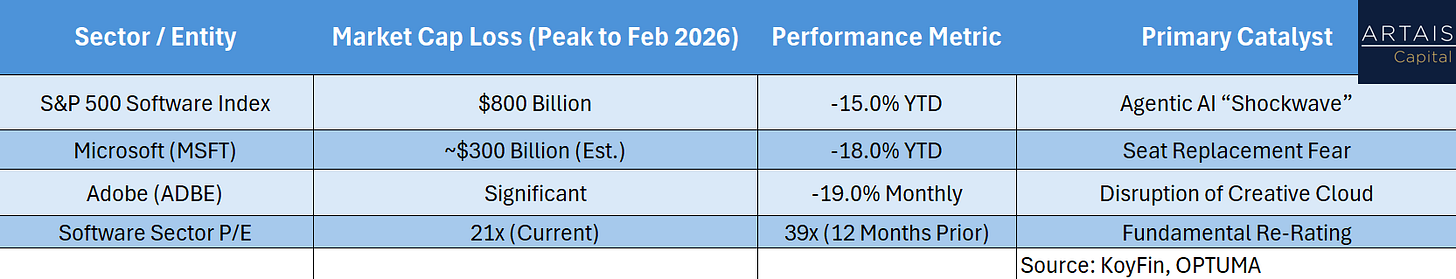

During the second week of February 2026, the market officially hit the “panic button” on the Software-as-a-Service business model.

The catalyst for this $800 billion rout was the release of Anthropic’s Claude Cowork, an agentic AI tool capable of navigating complex enterprise software, executing legal reviews, and managing financial triage without human oversight.

This introduction represents an inflection point where AI transitioned from a mere productivity booster to an autonomous agent capable of replacing human workflows entirely.

The so-called “Software-mageddon” saw nearly $300 billion in market value evaporated from the application software layer.

The core fear among investors is the “seat-sensitive” nature of software revenue. For over a decade, the “per-seat” subscription model provided predictable, recurring revenue.

However, if an AI “agent” can perform the work of dozens of junior associates, the need for seat licenses diminishes exponentially.

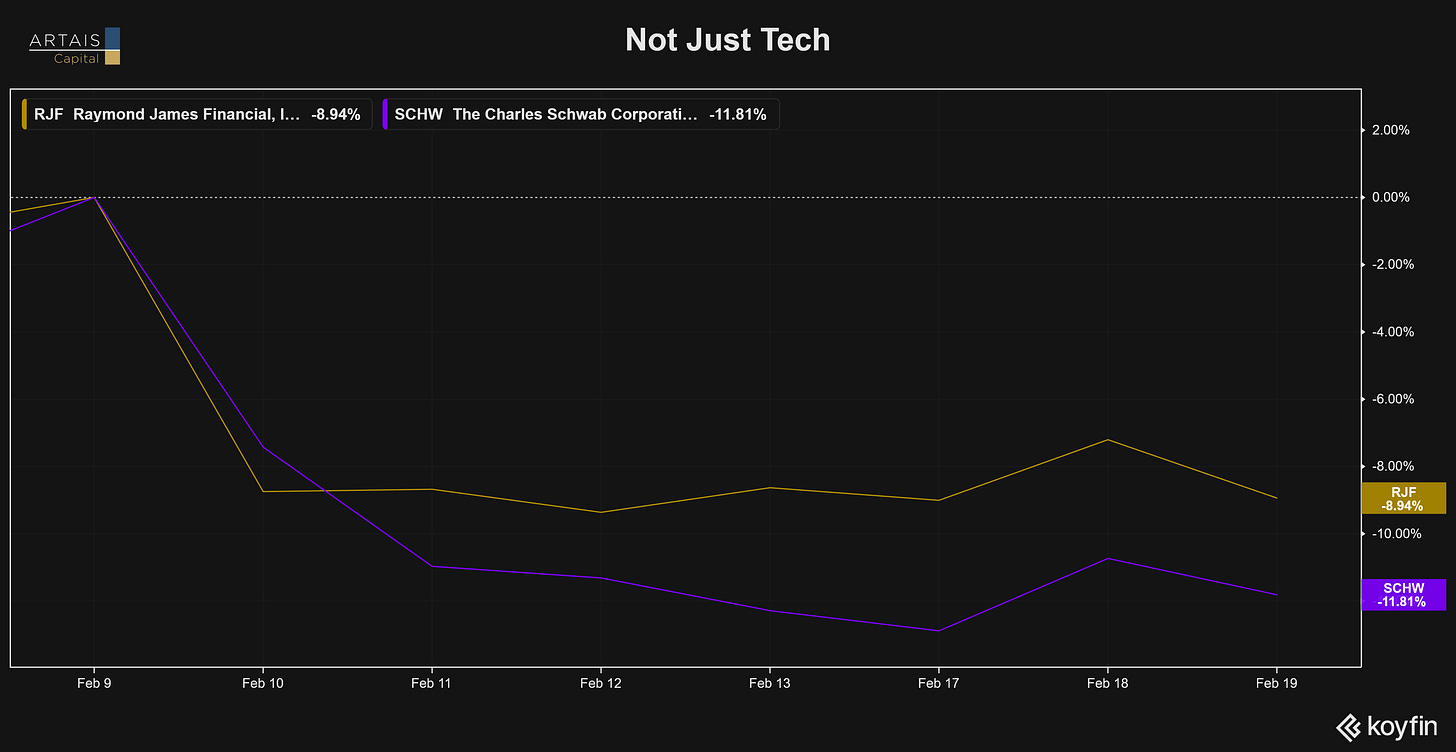

Not Just Tech

The selloff has not been confined to pure-play software firms. Wealth management, private credit, insurance, and real estate services were also hit.

Firms like Raymond James and Charles Schwab saw declines of 8.9% and 11.9%, respectively, as the market began asking “who is next” in the path of AI-driven displacement. (as of 2/19/26)

An Opportunity?

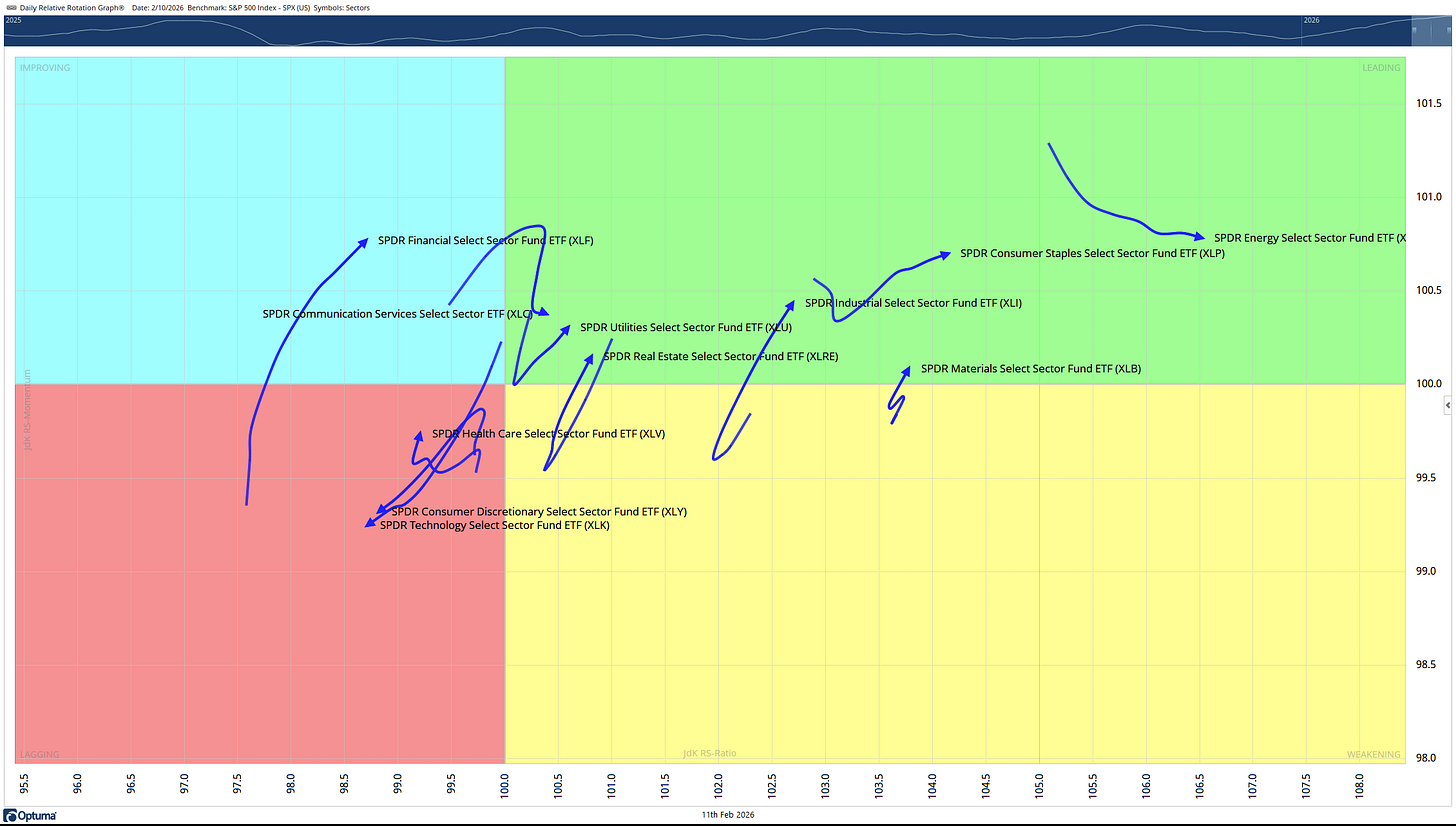

Previously, I wrote how value stocks were leading the market since last Fall: The NVIDIA Trap: Why the S&P 500 is Flat While New Winners are Soaring, where I discussed how the market dynamics of were being defined by a large rotation in value. (If you are not familiar with RRGs, reference the above article for a brief primer.)

During this period, Energy and Industrial sectors were leading the market with strong momentum, while previous leadership sectors, like Tech, were getting weaker.

As of 2/11/26

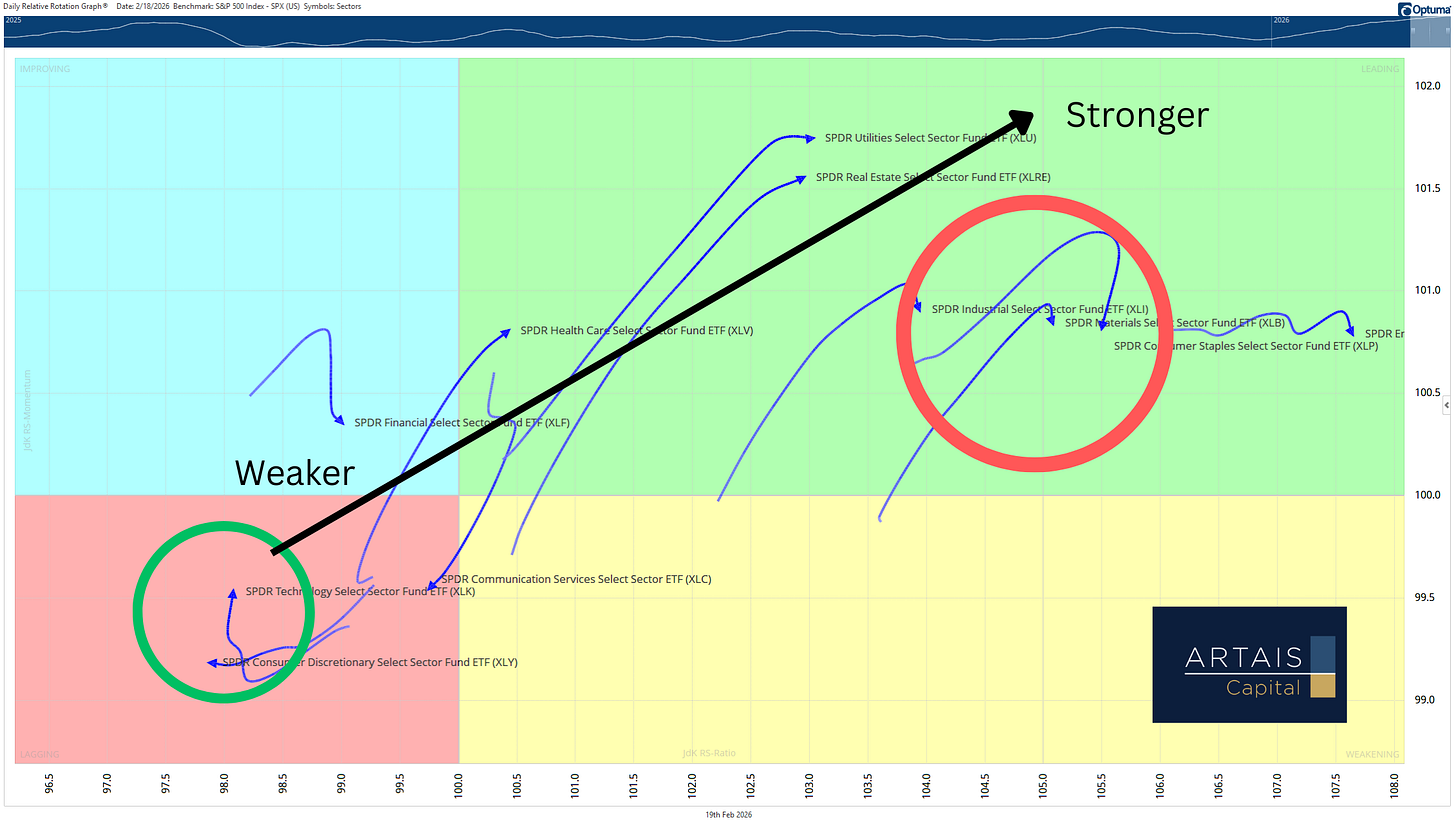

However, I am now seeing an opportunity in Technology, as the rotation is signaling an end to this trend. (Whether this is a short or long-term trend/trade has yet to be seen).

Currently, Relative Rotation Graphs are showing strength coming back to Tech, at the expense of value sectors, like Materials, Industrials, and Consumer Staples.

The weakness in value sectors is occurring at levels, that in my work, are price targets - reaching the upper band of their long term trend:

To me, this further confirms the rotation that is beginning to occur.

The “Value” in RRG Charts

You may be asking “John, why is a sector in the lagging quadrant an opportunity?

Mathew Verdouw, CMT, CFTe, who is the founder of OPTUMA software (and just an overall smart guy) wrote a white paper titled: Buying Outperformers is Too Late.

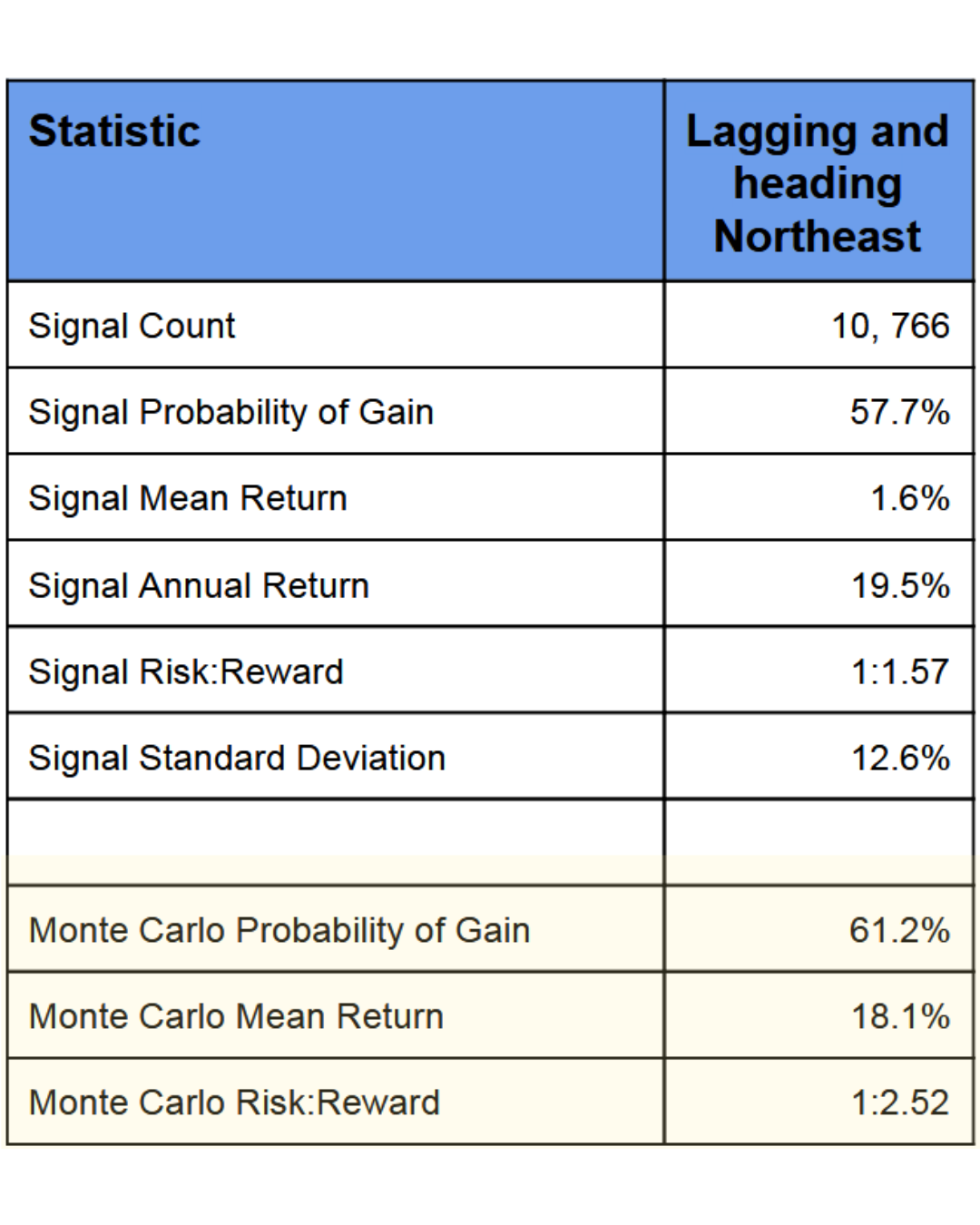

In his white paper, he tested various market rotation scenarios, including what happens after a sector that is in the lagging quadrant begins to “curve” towards strength — which he refers to as heading Northeast.

Source: Buying Outperformers is Too Late

As you can see, the testing Mr Verdouw did shows some pretty impressive results.

Microsoft

Remember, the above chart showing the Industrial sector reaching its upper trend line?

Now, let’s look at Microsoft:

The Microsoft chart is showing us the opposite of the Industries sector. The price has reached the bottom of its long term trend.

Wall Street is taking notice too, which can further help support continued rotation back into Tech stocks.

J.P. Morgan strategists are now calling out what they term as “Broken Logic” in the current market selloff.

The core of their argument is simple: if agentic AI is truly set to disrupt the entire software industry, then the “hyperscalers” building the infrastructure for that disruption—Microsoft, specifically—should be seeing a massive valuation premium, not a 13–18% haircut.

They note that the market is selling indiscriminately, punishing the very companies that own the “AI supply chain” alongside the legacy software firms they are supposedly replacing.

While the “seat-sensitive” model is under fire, the fundamental Moat for Microsoft remains its massive $281 billion backlog in AI service contracts.

Morgan Stanley recently issued a note highlighting that Microsoft is currently “under-owned” by institutional standards, suggesting that the capex fatigue currently spooking investors is masking a coming-of-age for the AI era.

Conclusion

From a technical perspective, the signals are reaching a point of historical exhaustion.

According to JP Morgan, the iShares Expanded Tech-Software Sector ETF (IGV) is trading over 20% below its 200-day moving average, the widest spread since the tail end of the dotcom crash.

Source: Bloomberg Finance L.P., JP Morgan

We are seeing this reflected on our Relative Rotation Graphs, where the tech sector’s tail is starting to "hook" toward the Northeast, signaling that the relative downtrend is decelerating and a rotation back into strength is beginning.

The current data suggests that there may be an opportunity for high-conviction names like Microsoft, as the gap between market perception and operational reality has finally created a tactical opportunity for the next leg of this cycle.